[ad_1]

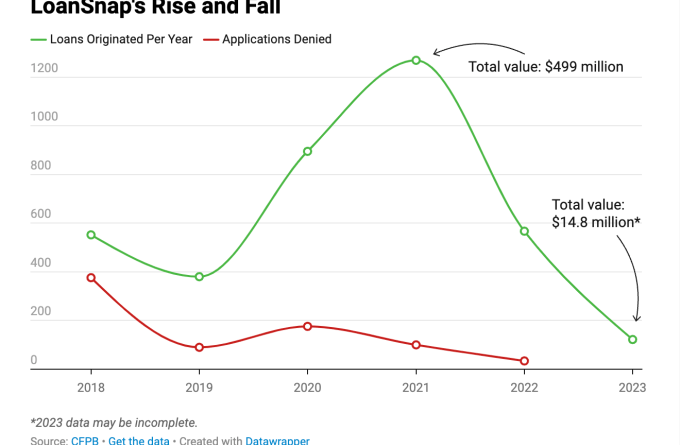

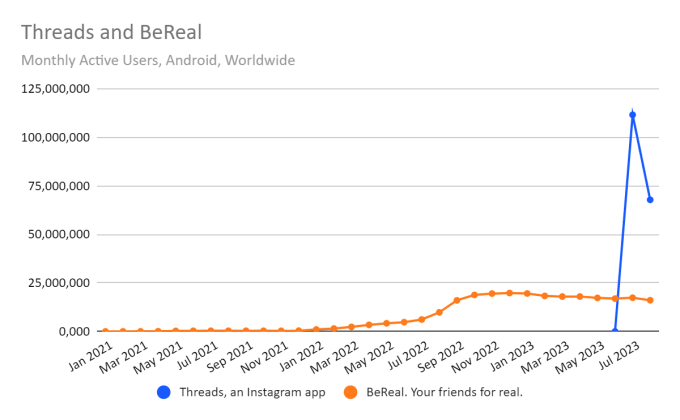

Just under a year ago, the buzzy new social app BeReal looked to be on the rise, with reportedly 20 million users launching the app every day to snap their candid photos. However, in the months since, BeReal’s traction has declined, according to a new report from Similarweb, despite its rollout of new features like messaging, the ability to post more photos and a “Friends of Friends” discovery feed. BeReal, however, disputes the new published estimates, saying that it’s still growing at a “healthy rate.”

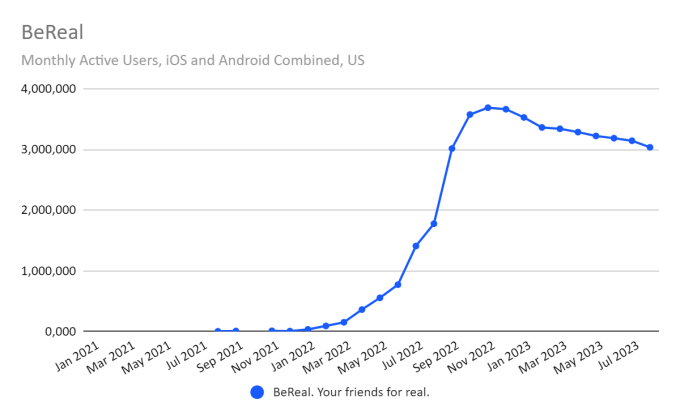

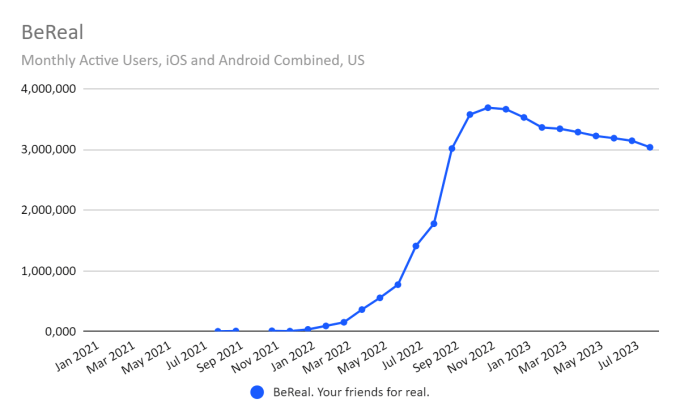

According to data compiled by the research firm Similarweb, BeReal has been losing traction in the U.S., where the app’s monthly active users on iOS and Android have declined from a peak of 3.7 million in November 2022 to just over 3 million this August.

BeReal, reached for comment, said this estimate was inaccurate, but declined to share its own segmented market metrics.

Image Credits: Similarweb

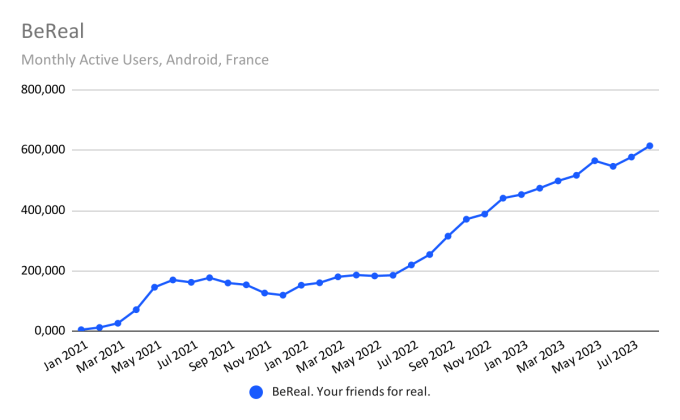

In addition, Similarweb told TechCrunch BeReal’s monthly active users globally have declined to 16.06 million. That would be a drop from last year’s reported 20 million — a figure that roughly lines up with Similarweb’s estimates from January 2022. This decline may have been even more significant except for the fact that BeReal usage has continued to grow in its home market of France, where the app is nearing 615,000 monthly active users in August on Android, up from less than 500,000 last year, Similarweb said.

BeReal pushed back at these findings as well, noting that its app has more than 25 million active users worldwide. It also pointed out that third-party reports are just estimates and its own internal numbers are more accurate.

Image Credits: BeReal

Of course, it’s common for new social apps to see a burst of activity and usage before settling down as some early adopters abandon the experience and only loyal users are retained. But in BeReal’s case, the app has been said previously to struggle with retention despite now adding new features and gaining mainstream notoriety as larger social media companies ripped off its front-and-back photo concept, including TikTok, Instagram and Snap.

The app, founded by former GoPro employee Alexis Barreyat along with Kévin Perreau, debuted on the market in December 2019 with an experience that mimicked an older social app Frontback that also leveraged both of the smartphone’s cameras to take photos at the same time. To some extent, BeReal grew by word-of-mouth, aided by its college ambassador program and features like WidgetMoji and RealMoji — that is, Home Screen widgets and the ability to react with stickers in iMessage conversations. But its rapid growth in 2022 was at the level that typically implied marketing or ad spend, not just organic adoption.

As it turned out, BeReal had the funds to send. The startup closed a Series B round of $60 million earlier in 2022, valuing the company at just under $587 million.

Unfortunately for BeReal’s longevity, photos of what people are up to at a random time of day — whenever BeReal issues its push notification — are ultimately not always as interesting as the curated photos of special moments that users publish on other photo-sharing platforms, like Instagram. Some BeReal users even came to understand this, in fact, and began staging their BeReals or waited until they were doing something worth sharing — like going out with their friends — before posting late.

Besides competition from the social media giants, BeReal is now facing an explosion of other new social apps demanding users’ time as myriad competitors have emerged to challenge Twitter, now called X.

For comparison, Instagram’s new app Threads has more than double the number of U.S. BeReal users, at nearly 7.3 million, Similarweb said. That’s despite Threads’ massive drop in usage shortly after its launch. In the third quarter, Threads jumped to 150 million downloads in its first week in early July — 5.5 times faster than any other app, says market intelligence firm data.ai. It even became the top app by downloads in the quarter, replacing TikTok as the new No. 1.

There’s also a new app called BeFake where users can post generative AI photos daily, which could have at least temporary appeal. The app has $3 million in funding. BeReal, however, can’t capitalize on consumer demand for generative AI apps because it would go against its main thesis: that social media is fake and its app is about authenticity.

Image Credits: Similarweb

Meanwhile, Instagram’s flagship app continues to have more than 48 times as many users in the U.S. versus BeReal, Similarweb noted.

But in one small win, BeReal is outpacing the Twitter/X rival Bluesky, the report said, where it has nearly four times as many monthly active users. However, Bluesky is in private beta and users need an invite to get in, so perhaps it’s not a fair comparison.

Still, even if BeReal’s internal metrics are accurate, growth from 20 million to 25 million daily active users in roughly a year is not a massive uptick. BeReal may need to figure out how to make its app more compelling to a larger group of users, which means more rapid development and tests of new features.

[ad_2]

Source link