[ad_1]

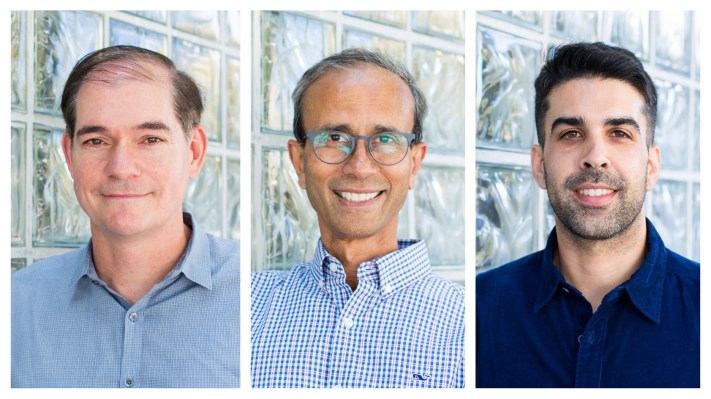

Thomvest Ventures is popping into 2024 with a new $250 million fund and the promotion of Umesh Padval and Nima Wedlake to the role of managing directors.

The Bay Area venture capital firm was started about 25 years ago by Peter Thomson, whose family is the majority owners of Thomson Reuters.

“Peter has always had a very strong interest in technology and what technology would do in terms of shaping society and the future,” Don Butler, Thomvest Ventures’ managing director, told TechCrunch. He met Thomson in 1999 and joined the firm in 2000.

As we’ve seen over the past few years, the venture capital industry can’t help but be cyclical. Thomvest has watched it for decades, and in 2010 decided to leave the generalist world behind to specialize in investment in a few key industries, Butler said.

“For example, every time a specialist in cybersecurity would speak, you knew that this was somebody who knew the market intimately, knew our competition, knew the customers, knew the market demand,” Butler said. “And we were like, ‘Okay, we want to be like them.’”

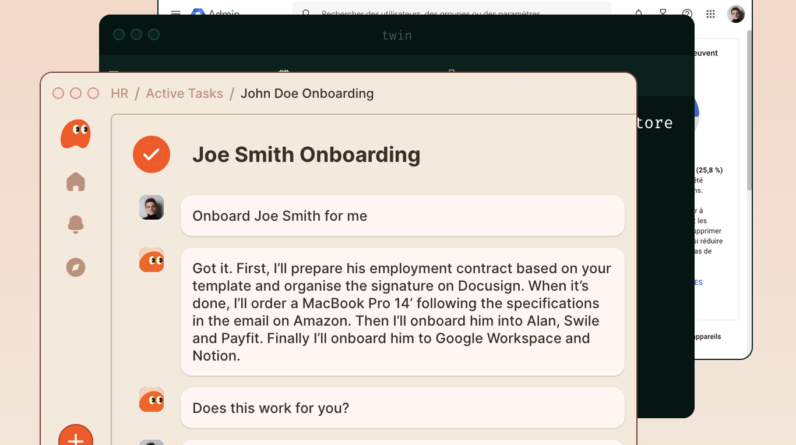

Today, Thomvest Ventures deploys capital in the areas of financial and real estate technology, cybersecurity, cloud and AI/data infrastructure.

The new $250 million in capital commitments brings the firm’s total assets under management to $750 million.

Butler expects to invest in between 25 and 30 companies from the new fund. Check sizes will be $5 million to $15 million for early-stage and $7 million to $25 million in the later stage. Thomson has made a few investments so far, but they haven’t been made public yet, he said.

“The last two quarters have yielded record numbers of new prospects for us,” Butler said. “At a later stage the best companies were able to get to some form of profitability and avoid sort of the repricing through the market. The internal investors knew what they had and said ‘We will take care of this.’ Now we’re starting to see companies that have gotten somewhere at the later stage and want to pick their growth rates back up.”

Thomvest raised its previous fund in 2017 and has made over 75 investments in total. Some notable companies include Blend Labs, Carta, Cohere, Kabbage, LendingClub, SoFi and Vungle.

Meanwhile, now managing directors, Umesh Padval will continue to lead investments into cybersecurity, cloud and AI/data infrastructure, while Nima Wedlake leads investments in real estate technology.

[ad_2]

Source link