[ad_1]

FEBE Ventures’ name stands for “for entrepreneurs by entrepreneurs,” and true to form, it is continuing to support seed-stage startups with the launch of its second fund. Targeting $75 million, Fund II is 2.5 times larger than FEBE’s first fund and 90% has already been committed. As part of the launch, FEBE Ventures also announced a co-investment partnership with Tekton Ventures.

FEBE Ventures was co-founded in 2019 by managing partner Olivier Raussin. So far, FEBE Ventures has backed more than 35 companies, including Locad, Zenyum, Tindle, Silverbird and Manatal. New members of its leadership team include Nicolas El Baze, who was a general partner at Partech and also founded several startups, including Microsoft-acquired Softway Systems; tech entrepreneur and angel investor Aditya Pendyala; and Tekton Ventures managing partner Jai Choi.

Fund II’s anchor partner is Otium Capital, an international family office founded by Pierre-Edouard Stérin, a serial entrepreneur whose startups include Smartbox Group. Otium Capital, which also backed FEBE Ventures’ first fund, manages $1.4 billion AUM in 100 investments and has seen more than 25% IRR since it was started.

While FEBE Ventures’ first fund focused on Southeast Asia, its second fund’s wide-ranging investment thesis is pre-seed and seed-stage companies across different geographies and sectors.

“We love B2B, but we also love healthcare. We love sustainability and climate tech,” Raussin tells TechCrunch. “But we are very people-driven, founder-centric and founder-driven. We always consider that founders know best, so we let them surprise us and we are more than happy to discover new industries and new themes.” Its typical check size will be around $250,000 for pre-seed startups and $750,000 for seed-stage companies.

FEBE II will still invest a lot in Southeast Asia, Raussin says, but one of the reasons it’s taking a more global approach is because of new collaborations that expand its network around the world.

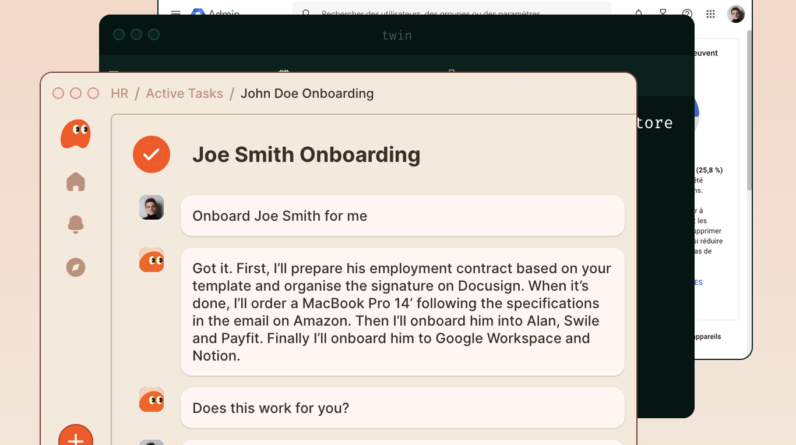

FEBE Ventures’ team

Febe Ventures’ new partner Tekton Ventures is the San Francisco-based tech investment arm of Partech founder Vincent Worms’ family office. Choi led its investments in unicorns in different countries, including Coupang, Toss, Merman, Newports, Flutterwave and Signifyd. The partnership will enable FEBE Ventures and Tekton Ventures to share their networks in Southeast Asia, Silicon Valley, Latin America and Europe and invest in more companies around the world, especially in emerging economies.

The partnership will see Choi and El Baze take on roles as Partner and Venture Partner, respectively, at FEBE Ventures.

All four members of FEBE Ventures’ leadership team are former entrepreneurs who, between them, have launched dozens of companies and worked as investors around the world, Raussin says. In backing startups, they look for the kind of services and products they dreamed of when they were starting companies.

That also influences the way they interact with founders, he adds. “We try to be very candid and authentic and share with a lot of humility the mistakes we’ve done in the past in order for them to save time. We also have a mindset of building sustainable businesses that generate EBITDA and profit in the long run.”

FEBE Ventures and Tekton Ventures decided to work together because both have global investment theses. “We are very geographically complementary and that is why we decided to craft these exclusive and long-term partnerships to work together with the co-investment scheme,” Raussin says. “We will be sharing our deal flow and co-investing together.”

In terms of FEBE Ventures’ collaboration with Otium Capital, Raussin said, “[Stérin] reached $1.4 billion starting from scratch, so he is really also an entrepreneur. We share the same human values and the same entrepreneurial mindset, and we collaborate well together.”

[ad_2]

Source link