[ad_1]

It’s not often you see an established company burn through three CEOs in less than a year. But through circumstances beyond its control, that’s what has happened at Slack, the company Salesforce acquired in 2020 for $28 billion. In November, Slack introduced Denise Dresser as the latest person to occupy the corner office.

Dresser acknowledges it wasn’t easy to step into the role under these circumstances, but she is settling in. “You know, like anything, it’s always hard to step into any new company and do it in a way that’s graceful, but I think the team gave me plenty of coaching, and we really saw the vision together,” Dresser told TechCrunch.

She grew up in the suburbs outside of Boston, was educated at the University of Massachusetts at Amherst where she studied accounting and worked at Salesforce for the last dozen years in various executive roles.

Her predecessor, Lidiane Jones, was just 10 months into the job when she announced she was leaving to be CEO at Bumble, driven by the allure of running a stand-alone public company. Jones herself had replaced company co-founder Stewart Butterfield when he announced that he was leaving at the end of 2022.

It’s difficult replacing a founder-CEO as Jones did. It could be even more challenging to take over just 10 months later for his successor, but some executive turnover is expected in the years following an acquisition, says Arjun Bhatia, a William Blair analyst who follows Salesforce. “You want a stable leadership team, of course, and you want someone who’s focusing on it, but the CEO turnover we’ve seen is not concerning at this point,” Bhatia told TechCrunch. “If that becomes more recurring, certainly that view might change, but I think it’s a natural course after an acquisition like this for a company like Slack to find its place inside the Salesforce ecosystem.”

Dresser says that she’s simply building on what her predecessors did before she got there, while bringing her own personality to the job. “I ask a lot of questions, and I definitely am an accountant at heart,” she said. “So I like to be organized and I’ll continue that on, but it’s not like it’s a big pull. I think the foundation is already there, and it’s an incredibly well-run organization.”

How has Slack fared at Big CRM?

When you look at the price that Salesforce paid to own Slack, even giving some leeway for 2020 stock prices and the over-exuberance of the period, it still feels like a reach. The belief at the time was that Slack could be the communication layer on top of all the business software that Salesforce sells. It’s still the hope, in fact, but revenue growth has slowed dramatically at Slack since its acquisition.

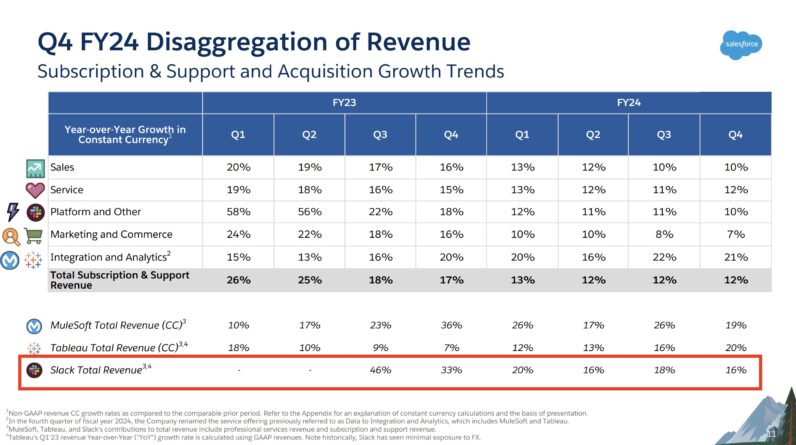

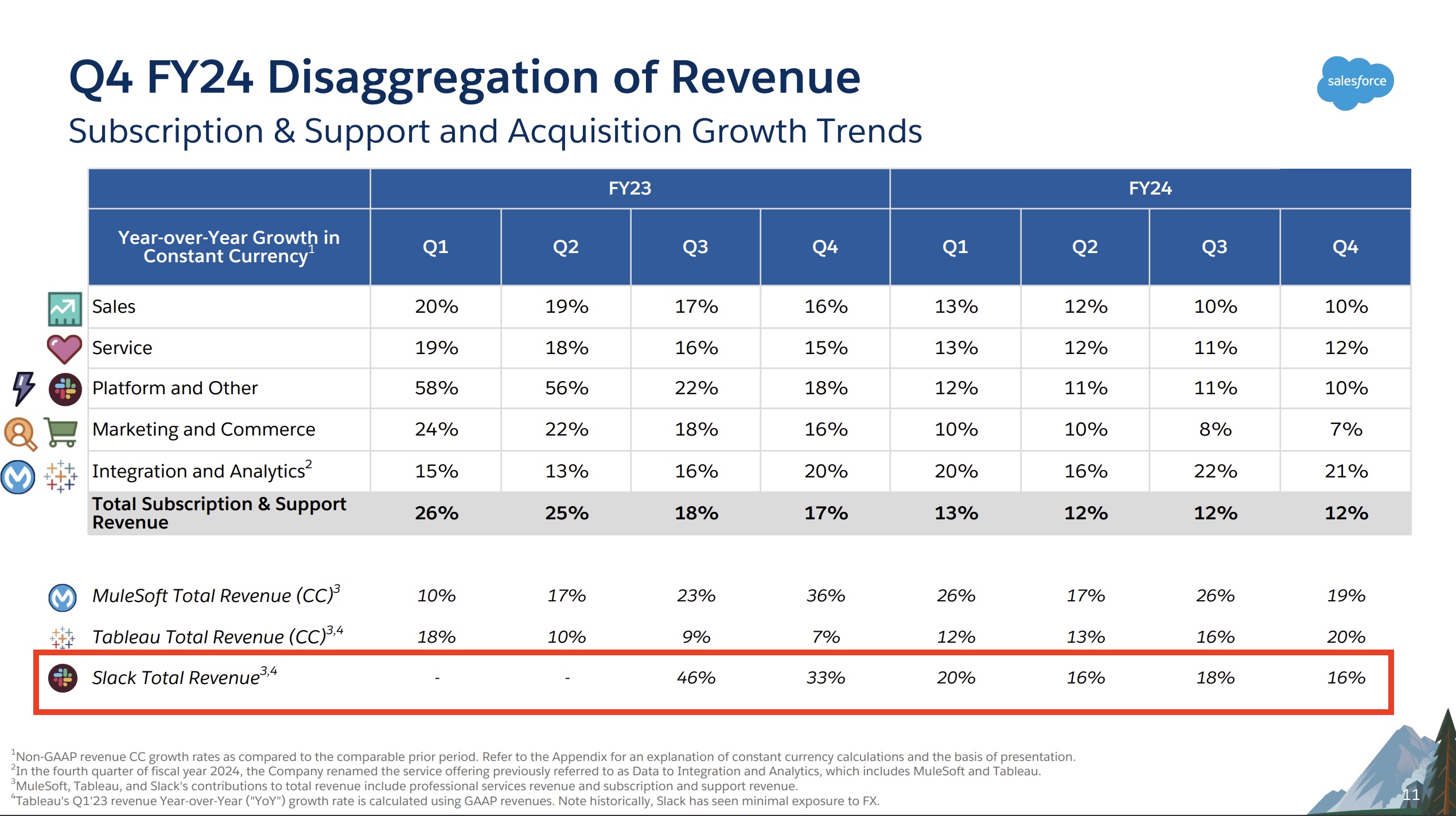

We don’t have exact revenue numbers because Salesforce stopped reporting them last spring, but it does share the percentage of growth from the prior year. Growth has slowed significantly from 46% YoY in Q32023 to just 16% in Q42024. For the most part, the trend has been down — and it’s up to Dresser to turn that around.

Image Credits: Salesforce

Slack could change this trend by finding new business opportunities and keeping existing customers happy while at the same time not being so closely tied to Salesforce that it loses customers who aren’t Salesforce-centric.

Dresser may be caught between these seemingly conflicting requirements, says Brent Leary, principal analyst at CRM Essentials. He, too, has been tracking Salesforce since its earliest days. “She’s got to be able to figure out what the right balance is between Slack as a standalone brand that continues to attract non-Salesforce customers, while enabling Salesforce customers to use Slack everywhere within the platform they need to collaborate,” Leary said.

But Dresser doesn’t think it’s all that complicated. “I don’t know if I think it’s that tough. I think it was the original vision when the two companies came together,” she said. “I think there’s a real recognition that there’s something very special here that we want to nurture and continue. And I think that’s been a pretty consistent theme from the very beginning.”

The potential of generative AI

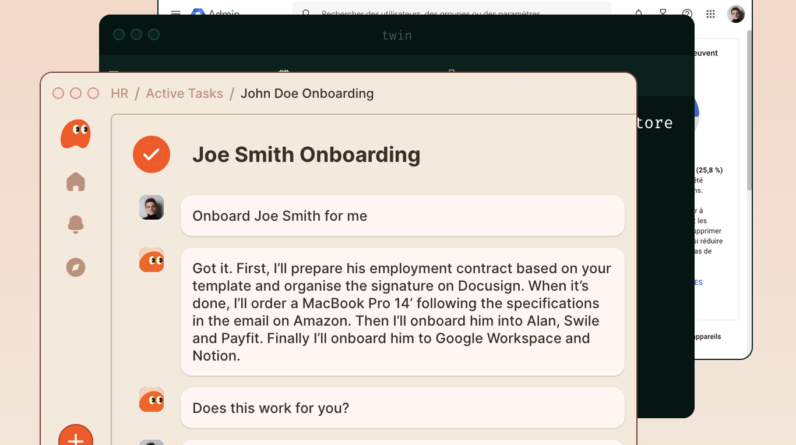

One big change she needs to manage has been the development of generative AI in software, in Slack and across the Salesforce family of products. Dresser says that AI is a natural fit for Slack because as a communications platform with lots of embedded knowledge, it will help users harness, understand and find knowledge nuggets in the mass of information.

“When you think about it from a higher-level perspective, Slack has so much of the world’s conversations happening in unstructured data,” she said. “And then you think about Salesforce having this incredible set of customer data, some of the world’s most valued data. The opportunity to bring structured and unstructured data into Slack and integrate those really creates this powerful platform for the future.”

All of that depends, of course, on execution: You can’t just sprinkle AI fairy dust on a product and hope it’s going to work. But Dresser claims that AI helped her get up to speed in her new position much more quickly than would have been possible without being able to access summaries of long product threads. Summarization is a big selling point for generative AI, and using it to save time understanding long conversational threads could be a big use case. But again, it depends on the quality of the summaries.

Another big issue Dresser faces is how to compete with Microsoft, which brings Teams to the table combined with Office 365, Dynamics 365, and AI in the form of Microsoft Copilot rolled out across the platform, says J. P. Gownder, an analyst at Forrester Research. “It’s logical for Slack to try to expand its user base by integrating Salesforce more closely, but it must be careful not to alienate existing customers, who are tremendously loyal to what’s offered today. In the meantime, Microsoft Teams is a behemoth that has a chance to grab even more minutes via Copilot,” Gownder told TechCrunch.

But Bhatia points out that Microsoft still works best inside the Microsoft ecosystem, and Slack may have an advantage in that regard. “Microsoft doesn’t have that interoperability play as much. Their advantage by far is distribution. And two big advantages that Slack has in their market are interoperability and ease of use,” he said.

One more degree of difficulty for Dresser is that the remaining Slack co-founder, CTO Cal Henderson, left at the beginning of March, replaced by none other than Salesforce co-founder and CTO Parker Harris. Even though Harris brings a long history of building Salesforce, Slack is losing a person who has a deep understanding of Slack’s technical underpinnings.

Dresser certainly understands that she faces these challenges ahead, that she needs to win over employees and customers and find a way to keep Slack growing and vital inside the vast Salesforce ecosystem. But she says her role is really about making human connections, and the rest will work itself out.

“I try to just help people understand that I’m here because I am deeply, deeply passionate about what we can do for the world, for our users, and our employees as well at Slack and the broader Salesforce — and I wouldn’t be here if I wasn’t.”

[ad_2]

Source link